Roth IRA vs. Traditional IRA: Which Is Better for High Earners?

Deciding between a Roth and Traditional 401(k) or IRA is a difficult and confusing process for high earners.

Both accounts offer tax advantages, but the “better” option depends on your income, tax bracket, career stage, and long-term goals.

In this guide, we’ll compare Roth IRAs vs. Traditional IRAs and explain which option may make more sense if you’re a high-income professional.

Roth IRA vs. Traditional IRA: The Key Difference

The main difference comes down to when you pay taxes.

Traditional IRA: You may get a tax deduction today, but withdrawals in retirement are taxed.

Roth IRA: You pay taxes today, but qualified withdrawals in retirement are tax-free.

The right choice depends on your tax situation both now and in the future.

How Traditional IRAs Work

How contributions are taxed

Traditional IRA contributions may be tax-deductible, depending on:

Your income

Your filing status

Whether you’re covered by a workplace retirement plan

For many high earners, deductions are limited or phased out entirely.

How withdrawals are taxed

Withdrawals in retirement are taxed as ordinary income

Required Minimum Distributions (RMDs) begin at age 73 (under current law in 2026)

How Roth IRAs Work

How contributions are taxed

Contributions are made with after-tax dollars

No upfront tax deduction

How withdrawals are taxed

Qualified withdrawals are completely tax-free

No RMDs during your lifetime

This makes Roth IRAs especially attractive for:

High earners expecting higher future tax rates

Investors seeking tax diversification

Those planning to leave assets to heirs

Contribution Limits and Income Restrictions

IRA contribution limits

Annual limit: $7,000

Age 50+: Additional $1,000 catch-up

Income limits (important for high earners)

Roth IRA contributions phase out at higher income levels

This can be avoided using a Backdoor Roth IRA

Traditional IRA deductions are limited if you have an employer plan

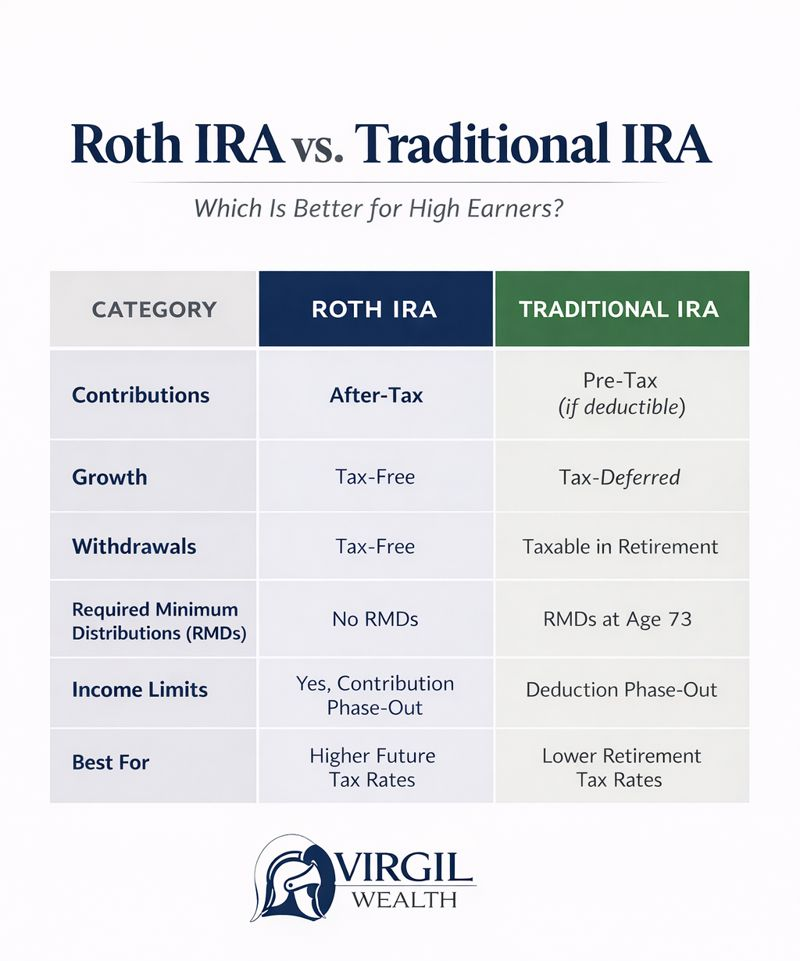

Side-by-Side Comparison

Which Is Better for High Earners?

When a Roth IRA May Be Better

A Roth IRA often makes sense if you:

Expect higher tax rates in the future

Want tax-free income in retirement

Are early or mid-career with income growth ahead

Want flexibility and no RMDs

Even if you can’t contribute directly, strategies like the Backdoor Roth IRA may still apply.

When a Traditional IRA May Be Better

A Traditional IRA may make sense if you:

Are in a peak earning year

Expect lower income in retirement

Can fully deduct contributions

Need immediate tax relief

However, many high earners cannot deduct Traditional IRA contributions, limiting the benefit.

What About Backdoor Roth IRAs for High Earners?

Because of income limits, many high earners use a Backdoor Roth IRA strategy:

Make a non-deductible Traditional IRA contribution

Convert it to a Roth IRA

When structured properly, this allows continued access to Roth benefits, but tax rules (like the pro-rata rule) must be managed carefully.

🔗 Related: Backdoor Roth IRA Explained

Common Mistakes High Earners Make

Assuming Roth IRAs are “off limits” forever

Ignoring the pro-rata rule

Failing to file Form 8606

Over-focusing on tax deductions instead of long-term flexibility

Not coordinating IRA decisions with employer plans

Final Thoughts

For high earners, the Roth vs. Traditional IRA decision is rarely black-and-white. The best choice depends on tax planning across your entire financial picture — not just this year’s return.

At Virgil Wealth, we help clients evaluate IRA strategies alongside investments, tax planning, and retirement goals to make informed decisions with confidence.

Want personalized advice? Schedule a free 15 minute consultation below!